Blog

Gig economy game-changer: Bankuish CEO, José Fernández

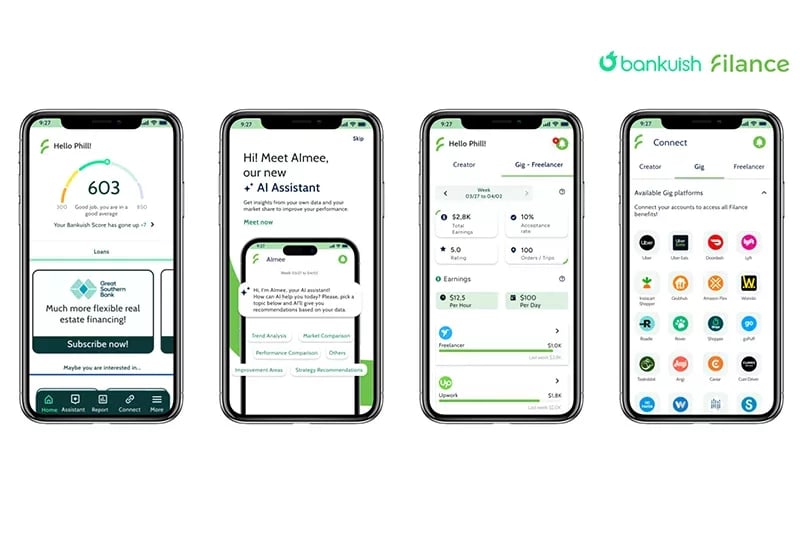

As the gig economy continues to evolve, traditional financial services haven't kept pace with these changes. José Fernández, founder and CEO of Bankuish, is working to bridge this gap by helping workers access fair financial products.

Having qualified as a Chartered Economist and worked as a credit risk expert at European banks including Banesto (now part of Santander) and ING Direct, Fernández understands both the challenges and opportunities in making finance more inclusive.

We talked to him about Bankuish's innovative approach to financial inclusion and his future vision for the business.

Congratulations on making the 4YFN final! Where do you see Bankuish in four years from now?

By 2028, we aim to be the preferred credit bureau for most major banks when assessing the creditworthiness of the future of work. We currently serve the largest banks of LATAM, and are successfully being adopted in the US; we wish to serve most major banks and insurance providers in the world by 2028.

What gives you confidence in achieving this vision?

Our confidence is rooted in the proven value we've already delivered to dozens of banking partners and hundreds of thousands of gig workers. Leading global financial and insurance institutions have already embraced our solutions, while user feedback consistently highlights how we've improved their financial and professional lives.

What are the main challenges you face?

One of the primary challenges lies in the slow adoption of alternative data by traditional institutions. While the benefits of integrating alternative data are clear, institutional inertia can delay the pace at which these changes are embraced. However, as results from early adopters demonstrate the transformative potential of our solutions, we anticipate a tipping point in the industry's willingness to innovate.

Finally, how is AI transforming your business and the sector?

AI impacts every aspect of our business. Our user base is growing exponentially thanks to the rise of AI, which is creating new forms of digital freelancers offering novel AI-empowered services through new digital marketplaces. Through AImee, our AI assistant, we provide gig workers with actionable insights into their performance metrics, such as earnings trends, acceptance rates, and productivity benchmarks.

To know more about Bankuish visit their site here and if you want to discover more about the 4YFN25 awards, check this out: 4yfn.com/4yfn-awards.